Watch the video below to hear more about our Multi-Asset Impact Strategy:

Multi-asset and impact investing - a productive combination

Our multi-asset impact strategy offers:

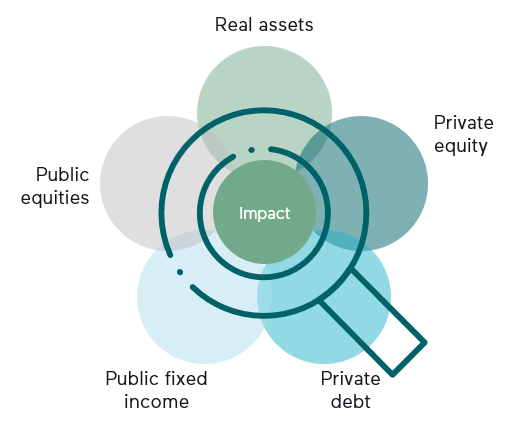

- Diversification, across listed and non-listed asset classes

- Risk premiums in less-liquid asset classes

- A competitive & compelling fee structure

- And finally: a founding and leading role in the impact sector

“We think the best way to address inequality is a mixture of systemic investing by influencing larger public companies, as well as grassroots investing through private small and medium enterprises where we affect change earlier in a company’s development.”

The power of impact investing

How families can create meaningful and lasting change

Inspired by our heritage

Multi-asset impact investing is inspired by our heritage of 100 years of values-based investing and is supported by our strong track record in multi-asset strategies.

While the investment industry is catching up with measuring impact, our strategy already focuses on solutions that are both high-impact and measurable. This way investors can make a real and noticeable difference.

All-weather portfolio

Over time, diversifying impact and financial risk-adjusted returns across multiple asset classes, with a balance between liquid and illiquid investments, creates an all-weather portfolio better able to withstand business cycles and different economic scenarios. The strategy aims for a financial return of at least Eurozone Core CPI Inflation + 3%.

Anthos Fund II RAIF-SICAV – Impact Investing Fund

Read the sustainability-related disclosures of the Anthos Fund II RAIF-SICAV - Impact Investing Fund

This is a marketing communication. Please refer to the Private Placement Memorandum of Anthos Fund II RAIF-SICAV S.A. ("PPM") before making any final investment decisions. The PPM may be provided upon request. Please note: these funds are open to professional investors only.

Want to create impact together?

Please connect with us to find out more about our multi-asset impact strategy.