Integration of sustainability risks in Anthos Fund & Asset Management’s investment decision-making process

This statement provides information on the policies of Anthos Fund & Asset Management (Anthos) regarding the integration of sustainability risks into its investment decision-making process. Under the EU Regulation on Sustainability-related Disclosures in the Financial Services sector (Regulation (EU) No. 2019/2088), sustainability risk means an ‘environmental, social or governance event or condition that, if it occurs, could cause a negative material impact on the value of the investment’.

In our policies, the integration of sustainability risks into our investment decision-making process is referred to as ‘ESG integration’, as used throughout this statement.

Overview

Anthos is part of COFRA. As part of the Brenninkmeijer family enterprise, the COFRA businesses build on six generations of entrepreneurship and responsible business ownership. Our long-term investment approach has always been inspired by values that are core to our investment beliefs: human dignity, sustainability and good corporate citizenship. We have formalised these values in a Responsible Investment Policy (RI Policy), anchored in three objectives:

- expressing our identity by the values that are core to our investment beliefs;

- enhancing financial value through ESG integration, leading to lower risk and/or improved returns; and

- enhancing our societal value.

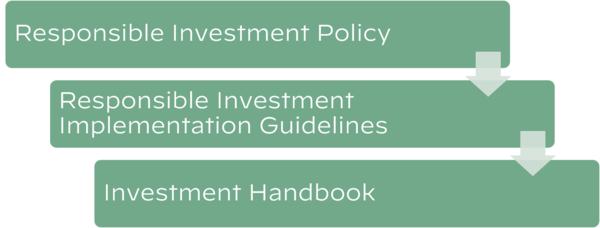

To further operationalise the three objectives specified in the RI Policy and ensure we understand the risks and opportunities stemming from ESG factors, we have developed our ESG positions and Exclusions policy, Stewardship policy, and RI Implementation Guidelines which in more detail explain how our asset classes implement these tools.

Figure 1: Policies overview

Anthos invests in various asset classes: equities, fixed income, private equity, real estate, impact and absolute return strategies. The RI Policy is applicable to all the assets under management, with implementation depending on the specific asset class and the way we invest. Except in the case of government bonds, Anthos invests through external investment managers, either using segregated investment mandates or investment funds.

Anthos therefore examines ESG integration at two main parts of the investment decision-making process: strategic asset allocation, and selection and monitoring of external investment managers. Our strategic asset allocation (SAA) process is typically performed once every three years. Within that longer-term strategic cycle, we perform an annual check of the SAA against macro-economic and financial market scenarios. In 2020 we started researching and evaluating how to integrate risks/opportunities stemming from climate change in SAA.

Identification of sustainability risks

Identifying sustainability risks at Anthos is done both qualitatively – through research and dialogue – and quantitatively – using data. By being part of DUFAS (Dutch Fund and Asset Management Association) and ascribing to the UN-backed Principles of Responsible Investment (UNPRI) we can expand our knowledge and ensure we are aware of the risks that we need to take into consideration when selecting investment funds and external investment managers.

Data plays a great role in identifying, monitoring and managing sustainability risks. While Anthos has no direct influence at a company level (because of investing indirectly), we use data to gain a better understanding of the ESG risks and carbon intensity of the portfolios we manage for clients. This data is especially relevant for our listed equities and corporate fixed income investments. For the other asset classes (real estate, private equity and hedge funds) we also use estimates and can calculate ESG risk and carbon intensity for individual sectors. However, we are largely dependent on our qualitative assessment of external investment managers’ capacity to do this.

Investment manager selection, monitoring and engagement

The Anthos portfolio management teams are responsible for external investment manager selection and portfolio management within the relevant asset class. In the selection process we assess how external investment managers integrate ESG and implement responsible investment in their processes. To do this more systematically and across all asset classes, we have developed an ESG scorecard, based on the UN-backed Principles for Responsible Investment Due Diligence Questionnaires (PRI DDQ), the OECD Guidelines for Institutional Investors and the GRESB framework for Real Estate. Anthos gives preference to external investment managers who are signatories of the UNPRI or an equivalent asset class-specific RI initiative (e.g. GRESB). Anthos also prefers external investment managers with an ESG policy defined specifically for the relevant investment fund or strategy that Anthos wants to invest in.

All other things being equal, Anthos will select external investment managers with a best-in-class ESG performance. Where external investment managers have an above-average financial performance but a sub-par ESG performance, Anthos will engage with these managers, with the aim of improving their ESG performance over time. We use the scores in the ESG scorecard for monitoring purposes. Our considerations in this respect are mostly qualitative. We also receive reporting from our external investment managers and are working to improve how we gather relevant data for monitoring and measuring risks. In the case of listed equity and fixed income investments, we use Sustainalytics and MSCI to obtain relevant data and assess ESG risks, including climate change risks, versus our chosen benchmarks.

Exclusions

While exclusions can be a useful tool when seeking to avoid ESG or sustainability risks, it is not always possible to implement them fully, especially for investment fund selectors such as Anthos. When selecting external investment managers, we therefore use the ESG scorecard to assess the exclusion policies of the investment funds we invest in. We aim to align with our and our clients’ policies and minimum standards and to measure each investment fund’s exposure to companies on the exclusion list. As our exclusion policy stems from our values, we aim to exclude products or activities that we do not want to be invested in. For more information see our ESG positions and Exclusion policy (PDF).

Statement on principal adverse impacts of investment decisions on sustainability factors

Summary

Anthos Fund & Asset Management B.V. (Anthos; LEI: 724500604XSTP9D0NU75) considers principal adverse impacts (PAI) of its investment decisions on sustainability factors. The present statement is the consolidated statement on principal adverse impacts on sustainability factors of Anthos. This statement on principal adverse impacts on sustainability factors covers the reference period from 1 January 2024 to 31 December 2024.

Integration of sustainability risks in Anthos Fund & Asset Management’s remuneration policy

This statement provides information on how the remuneration policy of Anthos Fund & Asset Management (Anthos) integrates sustainability risks.

Anthos has implemented a remuneration policy in compliance with the relevant EU regulation. As part of our incentive scheme and remuneration policy, we have integrated the following sustainability-related measures into the KPIs for our investment professionals:

- Be ahead of the curve in implementing Responsible Investment (RI) as part of overall portfolio construction;

- Contribute to our Multi-Asset Impact fund to generate ideas and assess opportunities;

- Contribute to integrating climate change, ESG and impact considerations into multi-asset portfolio construction and investment strategy implementation.