Summary

The impact objective of the Anthos Fund II RAIF-SICAV – Impact Investing Fund (hereinafter: the ‘Fund’) is to use capital as a force for good by delivering positive, measurable social and environmental outcomes while generating attractive risk-adjusted financial returns. The Fund generates impact by adressing unmet needs for people, communities and the planet, by providing access to essential products and services, that are affordable and of good quality, contributing to positive social and environmental impact at scale.

This objective is pursued through investments aligned with four impact themes:

- Access to Healthcare – Improving access to affordable, quality healthcare products and services, particularly for low-income populations, addressing healthcare inequality and improving well-being.

- Access to Education – Increasing availability and quality of education and digital learning tools, supporting improved learning outcomes, affordability, and employability.

- Financial Inclusion – Expanding access to affordable, high-quality financial services for underserved individuals and MSMEs, improving financial health, resilience and economic opportunity.

- Climate – Supporting the transition to a low-carbon, climate-resilient economy through clean energy generation, energy efficiency, and decarbonisation solutions.

The Fund’s impact ambition is grounded in Anthos’ core values: sustainability (protecting the environment), human dignity (elevating people and communities), and good corporate citizenship (rethinking the economy) and operationalised through a robust impact measurement and management framework based on the five dimensions of impact (What, Who, How much, Contribution, Risk).

The Fund will invest indirectly in impact investing, by participating in external impact investment funds (‘impact funds’). This financial product may also invest in ETF’s.

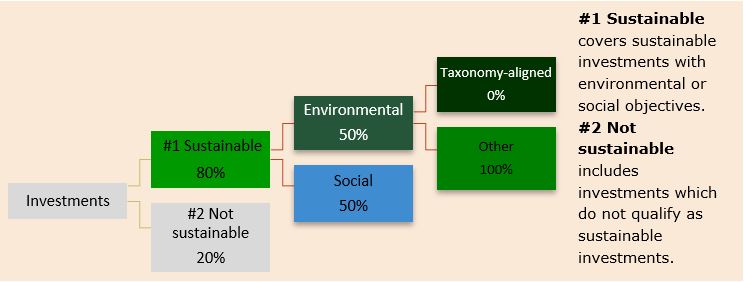

The Fund seeks to invest at least 80% of its assets in impact funds that qualify as sustainable investments with environmental or social objectives. This financial product seeks to invest a maximum of 20% of its assets in investments that do not qualify as sustainable investments. This includes investments in cash and money market instruments for liquidity management purposes and derivatives for hedging and efficient portfolio management purposes.

As a fund of funds, the Fund invests in investments that are managed by other investment managers. Anthos therefore requires that the investment managers of these external investment funds demonstrate to Anthos that the underlying investments do not significantly harm the sustainable investment objectives of the respective external investment funds. Anthos also identifies and monitors the potential adverse impacts of the investment funds this financial product invests in by assessing the ESG investment practices implemented by the external investment managers of these investment funds, and more specifically obtaining information from them on the potential adverse impacts they make through their investment fund’s underlying investments. Anthos expects the investment managers of these investment funds to assess good governance practices of their investee companies. Furthermore, this financial product is assessed on a periodic basis (mostly yearly) to determine whether an investee company is violating or at risk of violating, one or more of the UN Global Compact Principles and related international norms and standards. This financial product qualifies the external investment funds included in this product with an ESG rating using Anthos proprietary tools. The ESG rating is the result of an internal assessment performed by the Anthos portfolio managers and analysts, based on the relevant information shared by the external investment managers themselves during the RFP phase or during engagement conversations that take place at least on a yearly basis. External investment funds eligible for consideration for this financial product should be assessed as a "Professional" or "Leader" in Anthos' ESG score. This assures Anthos that the underlying investee companies do not cause significant harm and have good governance practices.

Anthos developed an impact assessment tool to assess and select external investment funds for this financial product. This financial product selects impact funds that have a clear impact intention and strategy, appropriate impact measurement and management practices and resources to execute on its impact strategy, and sufficient impact reporting to assess performance against the strategy. Impact potential is scored by looking at the impact strategy, impact measure and management practices, impact governance and impact reporting capabilities of the external investment fund and the investment manager Anthos wants to invest in. The impact funds are also assessed to ensure that their impact objective aligns with Anthos’ focus impact themes. To do so, per impact fund one or more sustainability indicators are chosen and monitored to ensure alignment between the impact themes and the impact objectives of the impact funds.

As a fund of fund manager, Anthos relies on its external investment managers for engagement in connection to the investee companies. However, Anthos believes it also needs to address active ownership through additional engagement activities, either via a service provider or, where possible, directly. This enhances investor stewardship and the pursuit of responsible investment.

Although a benchmark is used for comparing its financial performance, this financial product does not use a specific benchmark to determine whether it is aligned with its sustainable investment objectives. This financial product attains its sustainable investment objectives through its investment guidelines, which are based on its investment strategy.

1. No significant harm to the sustainable investment objective

As a fund of funds, the Fund invests in investments that are managed by other investment managers. Anthos therefore requires that the investment managers of these external investment funds demonstrate to Anthos that the underlying investments do not significantly harm the sustainable investment objectives of the respective external investment funds.

Anthos also identifies and monitors the potential adverse impacts of the investment funds this financial product invests in by assessing the ESG investment practices implemented by the external investment managers of these investment funds, and more specifically obtaining information from them on the potential adverse impacts they make through their investment fund’s underlying investments. Pre-investment, Anthos assesses these external investment managers on a wide scope of criteria (Negative impacts of the portfolio to the world, exclusions applied to the investment funds, Diversity, Equity & Inclusion, climate change) using the Anthos ESG Scorecard. This financial product only invests in investment funds that score either as ‘Professional’ or ‘Leader’ on the Anthos ESG scorecard.

This financial product implements Anthos' exclusion list by communicating the exclusions criteria to its external managers during the pre-investment phase. This exclusion list is included in the side letter upon investment. Businesses that should be eliminated include tobacco, gambling, controversial weapons, adult content when they are responsible for more than 5% of revenues. The external investment funds usually already have an exclusion list aligned with Anthos’ exclusion list or aligned with the IFC exclusion list (which is stricter than Anthos’ exclusion list).

Anthos integrates the OECD Guidelines for Multinational Enterprises (MNEs) and the UN Guiding Principles on Business and Human Rights (UNGPs) through a commitment to human rights, responsible investing, and sustainability. The impact team adopts risk-based due diligence across its investment process, ensuring that ESG factors are embedded next to an impact assessment to address social, environmental, and governance risks while aligning portfolios with sustainable development goals. An exclusion list is a starting point to determine where there should not be an exposure from values and sustainability perspective. The RI scorecard, which is at the core of the due diligence process, includes all the relevant questions for the assessment of the external manager's capacity to identify and manage potential and actual risks and impacts. The same scorecard questionnaire is used throughout the investment period to engage and work towards improvement.

The fund excludes investments following Anthos Exclusion Policy and where more restrictive, the ESMA (PAB) exclusions. For public markets we use benchmark administrators to screen, and for private markets we include these in our side letter, and we focus on the sector exposures for screening. See below, under 3. Investment strategy, for the list of exclusions taken into account.

2. Sustainable investment objective of the financial product

The impact objective of the Anthos Impact Investing Fund (“Fund”) is to use capital as a force for good by delivering positive, measurable social and environmental outcomes while generating attractive risk-adjusted financial returns. The Fund generates impact by adressing unmet needs for people, communities and the planet, by providing access to essential products and services, that are affordable and of good quality, contributing to positive social and environmental impact at scale.

This objective is pursued through investments aligned with four impact themes:

- Access to Healthcare – Improving access to affordable, quality healthcare products and services, particularly for low-income populations, addressing healthcare inequality and improving well-being.

- Access to Education – Increasing availability and quality of education and digital learning tools, supporting improved learning outcomes, affordability, and employability.

- Financial Inclusion – Expanding access to affordable, high-quality financial services for underserved individuals and MSMEs, improving financial health, resilience and economic opportunity.

- Climate – Supporting the transition to a low-carbon, climate-resilient economy through clean energy generation, energy efficiency, and decarbonisation solutions.

The Fund’s impact ambition is grounded in Anthos’ core values: sustainability (protecting the environment), human dignity (elevating people and communities), and good corporate citizenship (rethinking the economy) and operationalised through a robust impact measurement and management framework based on the five dimensions of impact (What, Who, How much, Contribution, Risk). The overarching long-term aim is to create tangible, scalable improvement in livelihoods and environmental outcomes, contributing to relevant Sustainable Development Goals.

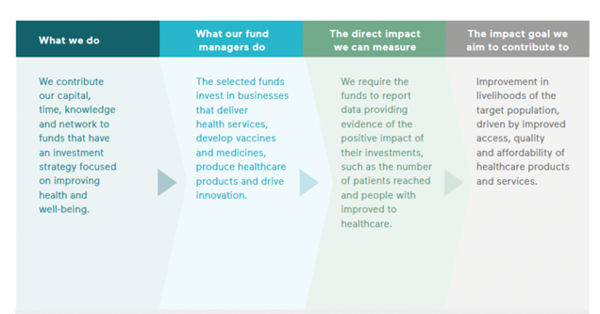

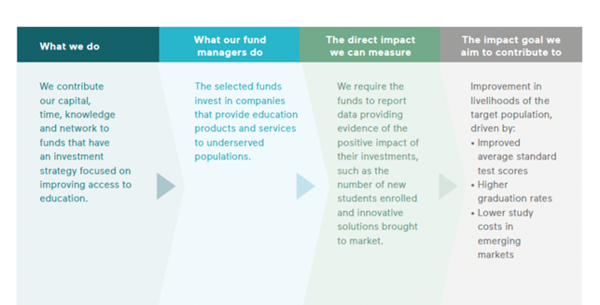

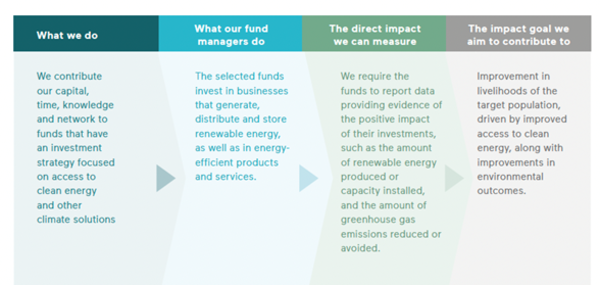

The Fund operationalises its sustainable investment objective through a Theory of Change (“ToC”) that structures how capital allocation leads to positive, measurable outcomes. For each of the four impact themes (Healthcare, Education, Financial Inclusion, Climate), Anthos applies a theme-specific ToC that identifies: (1) the inputs provided by the Fund (capital, expertise, engagement), (2) the activities of underlying fund managers, (3) the outputs measured through indicators, and (4) the longer-term outcomes aligned with relevant SDGs.

3. Investment strategy

The Fund pursues a global multi-manager, multi-asset impact investing strategy aimed at generating attractive risk-adjusted financial returns while delivering positive, measurable social and environmental outcomes. It invests primarily through external investment funds and, where appropriate, ETFs, directing capital toward the four clearly defined impact themes as mentioned above.

These four investment themes are grounded in Anthos’ core values—sustainability, human dignity and good corporate citizenship—and are operationalised through a robust Theory of Change framework that structures how capital allocation leads to measurable impact. For each theme, Anthos defines:

- the inputs provided to investment funds,

- the activities of fund managers,

- the output indicators monitored annually, and

- the long-term outcomes aligned with the Sustainable Development Goals (SDGs).

This ensures that every allocation contributes to a clearly defined, evidence-based impact pathway.

The following binding elements apply to attain this financial product’s sustainable investment objective.

Thematic allocation to four impact themes.

The Fund allocates capital to investments that contribute to one or more of the four defined impact themes:

- Financial Inclusion

- Access to Education

- Access to Healthcare

- Climate

ESG Manager Ratings (“Professional” or “Leader”)

External investment funds eligible for consideration for this Fund should have an investment manager that is assessed as a "Professional" or "Leader" in Anthos' ESG score.

Impact assessment

- External investment funds eligible for consideration for this financial product should obtain an Impact score of 7 and higher.

- External investment funds eligible for consideration for this financial product should have an Impact label of “Benefit stakeholders (B)” or “Contribute to solutions (C)”.

Anthos Exclusion Policy and the (ESMA) PAB exclusions

- The Fund excludes investments following Anthos Exclusion Policy (as published on the website) and where more restrictive, the ESMA (PAB) exclusions. For public markets we use Sustainalytics to screen, and for private markets we include these in our side letter, and we focus on the sector exposures for screening.

o Companies that have any % revenue from developing, producing, stockpiling or selling controversial weapons

o Companies that have 5% or more revenue coming from manufacture, sale of assault weapons to civilians or military and law enforcement customers; manufacture or sale

of key components of small arms; manufacture of weapons or weapons systems; providing tailor-made products or services for weapons or weapon systems. Does not

include companies that provide dual-use products and services.

o Gambling: Companies that have 5% more revenue coming from ownership or operation of gambling establishments, specialized equipment and supporting products

and services.

o Tobacco: Companies that have any % revenue coming from production, manufacturing of tobacco products. And 5% from retail.

o Pornography/adult entertainment: Companies that have 5% or more revenue from pornography, adult entertainment, production or distribution thereof.

o Coal: Companies that derive 1 % or more of their revenues from exploration, mining, extraction, distribution or refining of hard coal and lignite.

o Oil sands: Companies that have 10% revenue from extracting oil sands, that own exploration license, lease and are currently drilling oil sands deposits.

o Arctic oil and gas exploration: Companies that have 5 % revenue coming from oil and gas exploration in the arctic.

o Companies that benchmark administrators find in violation of the United Nations Global Compact (UNGC) principles or the Organisation for Economic Cooperation and

Development (OECD) Guidelines for Multinational Enterprises.

o Oil fuels: companies that derive 10 % or more of their revenues from the exploration, extraction, distribution or refining of oil fuels.

o Gasseous fuels: companies that derive 50 % or more of their revenues from the exploration, extraction, manufacturing or distribution of gaseous fuels; e/kWh.

o Electricity intensity: companies that derive 50 % or more of their revenues from electricity generation with a GHG intensity of more than 100g CO2.

o Sovereign bonds of countries with EU/UN sanctions directed at central governments and including an arms embargo.

4. Proportion of investments

This financial product seeks to invest at least 80% of its assets in external investment funds that qualify as sustainable investments with environmental or social objectives. This financial product seeks to invest a maximum of 20% of its assets in investments that do not qualify as sustainable investments. This includes investments in cash and money market instruments for liquidity management purposes and derivatives for hedging and efficient portfolio management purposes.

5. Monitoring of the sustainable investment objective

This financial product does not invest directly in investee companies, but indirectly, through its direct investments in investment funds. Before investing in a new investment fund for this financial product, Anthos performs an assessment on the policies of the investment manager of that investment fund, including whether material ESG factors – such as good corporate governance practices at investee companies – are considered in the investment process. Such assessment of the investment manager is repeated by Anthos on a periodic basis (mostly yearly). Furthermore, this financial product is screened on a periodic basis (mostly yearly) to determine whether an investee company is violating or at risk of violating, one or more of the UN Global Compact Principles and related international norms and standards.

In addition to this, Anthos engages on a regular basis with the external investment managers on the components of the ESG scorecard to:

a) ensure the ESG rating correctly reflects the responsible investments practices of the investment manager; and

b) signal the importance of responsible investing, highlight Anthos' expectations about key ESG characteristics (for example, Climate Change, DEI and Human rights) and monitor the progress made against Anthos' expectations.

6. Methodologies

Anthos uses the sustainability indicators set out below to measure the attainment of the sustainable investment objectives of the investments in the Fund. The sustainability indicators used by the Fund correspond directly to the ‘direct impact’ layer of the Fund’s ToC for each theme. These indicators represent measurable outputs that demonstrate progress toward the intended outcomes defined in each ToC.

Healthcare indicators (SDG3):

# People with improved healthcare

Education indicators (SDG 4, 8, 10):

# Students provided with access to education

# Students provided with digital tools

# Adult learners supported

Financial inclusion indicators (SDG 1, 8, 10):

# Underserved individuals reached

# Underserved MSMEs enabled

# Farmers with improved yields and incomes

Climate indicators (SDG 7, 9, 13):

# Carbon emissions reduced or avoided

# Renewable energy capacity supported

In addition, Anthos uses the following sustainability indicators to assess how the Fund’s sustainable investment objectives are met, namely, investing in external impact funds and ensuring that their impact objectives contribute to Anthos’ values.

ESG Assessment

# Funds managed by Professional or Leader ESG-rated managers, according to Anthos’ proprietary ESG scorecard

Anthos Exclusion Policy

# Adherence to the Anthos Exclusion policy

# Adherence to the PAB exclusions

7. Data sources and processing

Anthos assesses all investment funds that are considered for this financial product on responsible investment practices and key ESG characteristics prior to investing, using its proprietary tools (ESG scorecard), The ESG rating shows the quality of the integration of environmental, social and governance assessments in the investment process at the investment manager.

The ESG rating is the result of an internal assessment performed by the Anthos portfolio managers and their analysts, based on the relevant information shared by the external investment managers themselves during the RFP phase or during engagement conversations that take place at least on a yearly basis.

8. Limitations to methodologies and data

Assessing the information shared by the external investment managers may be influenced by the amount of knowledge of the Anthos staff performing the assessment on ESG practices, ESG topics, market standards, etcetera. Anthos mitigates this limitation by providing regular training to its staff, either on processes or specific topics (for example climate training and human rights workshops). The Anthos ESG scorecard are accompanied of a scoring guide which indicates which kind of requirements lead to specific ratings/labels/scores.

The assessments are also reviewed by the Anthos Responsible Investments Team on a need basis and the tools are continuously improved to keep up with market standards.

Anthos aims to incorporate outcomes in its assessment, as external ESG and Impact data becomes more reliable and methodologies more robust.

9. Due diligence

As part of the due diligence process the external investment manager as well as the investment fund are investigated by the portfolio manager. Therefore, the external investment manager has to provide the information necessary for Anthos to be able to perform the sustainability assessment. Once the information is received, Anthos will assess the information resulting in an ESG score ‘Laggard’, ‘Novice’, ‘Professional’ or ‘Leader’.

Anthos assesses the governance structure and resources of the external manager to manage environmental, social and governance issues and integrate in the investment process. The assessment contributes to the final rating of the managers on ESG (Laggard-Leader) which helps the portfolio managers make a decision.

During the due diligence, the first assessment is done by the portfolio manager, together with their analysts. The assessments are also reviewed by the Anthos Responsible Investments Team on a need basis and the tools are continuously improved to keep up with market standards.

10. Engagement policies

As a fund of fund manager, Anthos invests in segregated mandates and investment funds managed by external investment managers, and it relies on these external investment managers for engagement and voting in connection to the investee companies. However, Anthos believes it also needs to address active ownership through additional engagement activities, either via a service provider or, where possible, directly. This enhances investor stewardship and the pursuit of responsible investment.

Anthos has high expectations of the external investment managers selected for this financial product and incorporates ESG considerations into the entire external investment manager due diligence and relationship lifecycle. Anthos expects the selected external investment managers to be signatories of the Principles for Responsible Investment (PRI) and to support the Principles of the European Fund and Asset Management Association (EFAMA) Stewardship Code or a similar guidance, which clearly outlines engagement and voting good practices for direct investors.

Internally, engagement is carried out by Anthos’s portfolio managers, who assess the ESG integration capacity and quality of the external investment managers of the investment funds that this financial product invests in. Anthos also engages via an external engagement service provider that engages on behalf of Anthos' clients, even when Anthos does not appear as shareholder at the investee companies in question. In this way Anthos gives its voice to the pool of like-minded investors wanting meaningful change.

More information on Anthos' engagement process and objectives can be found in its Stewardship Policy.

11. Attainment of the sustainable investment objective

Although a benchmark is used for comparing its financial performance, this financial product does not use a specific benchmark to determine whether it is aligned with its sustainable investment objectives. Going forward, Anthos will keep on monitoring whether any benchmark could become relevant regarding the sustainable investment objectives of this financial product. This financial product attains its sustainable investment objectives through its investment guidelines, which are based on its investment strategy.