Inflation: sowing the seeds of its own demise

Wouter ten Brinke, Managing Director Client Portfolio Management at Anthos Fund & Asset Management, shares his views on the current economic environment.

What a difference a month makes

In the past few weeks, financial markets have been aggressive in re-pricing risk from labour market tightness and inflationary risks (and subsequently higher interest rates), to concerns about an economic recession. A broad-based decline in commodity prices is underway, market expectations for inflation have been scaled down significantly, and interest rate markets now expect the US Federal Reserve (Fed) to cut its policy rate by almost 1% between the end of this year and mid-2024. It’s clear markets are realizing that demand destruction is working – what a difference a month makes.

These recession concerns add to a market which is already struggling with the rapid withdrawal of excess liquidity by central banks and fiscal stimulus by governments. Indeed, in January 2022, we wrote to our clients: “our two measures of excess liquidity […] suggest that S&P500 valuations (and possibly returns) could decline materially going forward.” Looking ahead, we expect the withdrawal of monetary and fiscal policy support to continue (the Fed’s pace of quantitative tightening (QT) will double in September, and banks are tightening their lending standards), putting further stress on market valuations.

Inflation is sowing the seeds of its own demise

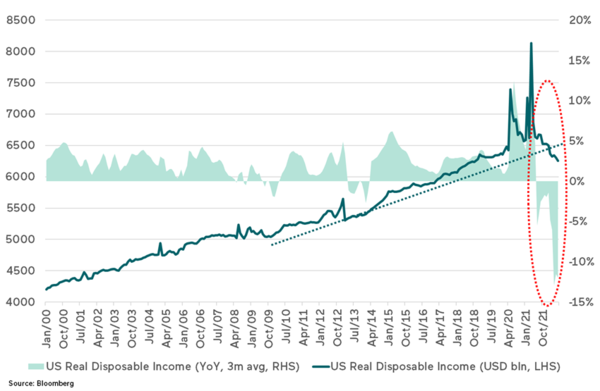

In addition, the ‘growth tax’ from higher core inflation, commodity prices, wage growth and interest rates is triggering a global economic slowdown and a corporate profit recession (negative earnings growth). Inflation is taking a huge bite out of consumer disposable income (see Figure 1) and the market correction has taken more than USD10 trillion (worth 50% of US GDP) from household net worth this year. Consumers are spending more US dollars but are getting fewer units, which is why inventories are surging. The decline in consumer buying power means companies have less pricing power and, together with rising input and financing costs, this means corporate profit margins are squeezed from both sides. Inflation is sowing the seeds of its own demise.

Figure 1: Inflation hurts: US consumers suffer from a collapse in real income

Sell into strength rather than buy on weakness

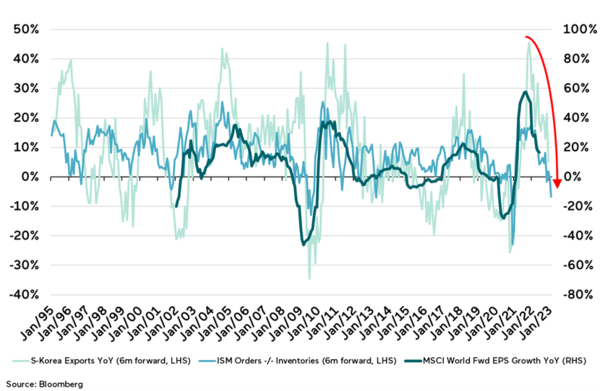

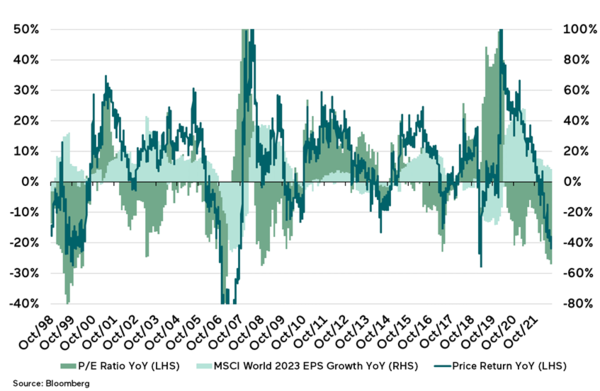

The outlook for global equities seems pretty binary from here. Following the decline in valuations so far this year, equity and credit markets remain vulnerable to further sell-offs, especially if we move into a broader global economic recession. Given the historical pattern of recessions (valuations first, with profits the next shoe to drop), earnings estimates could easily decline by another 10-15% from current levels, which are still quite high in the context of fundamentals (see Figures 2 and 3). This would also mean more upside for the US dollar and more downside for commodities. On the other hand, we could see a bear market rally over the next few months, on the back of falling inflation fears and pricing of less aggressive Fed policy. But given the economic and profit fundamentals, such a rally is not likely to last for long. In a fundamental bear market, stocks tend to bottom only when leading economic indicators bottom. In terms of investment strategy, this means selling into strength rather than buying on weakness.

Historically, economic recessions are often preceded by economic overheating, signs of which we are all seeing today in the US and Europe: high unit-labour cost growth, high core inflation and large cumulative increases in central banks’ policy rate. Services inflation is now also running hot with hotels/motels and airfares inflation in the US well above 20%…this hurts. In Europe, a natural gas shock may already be unfolding and in the US, a stressed housing sector signals more trouble ahead. Don’t wait for the unemployment rate to turn: it is a lagging indicator. Jobless claims are leading and have been rising since April: plenty of companies are now giving profit and layoff warnings. The same goes for inflation: big declines in inflation always occur only after recessions start.

Figure 2: Corporate earnings recession is imminent

Figure 3: Equity valuations decline first, earnings growth estimates follow suit

“Muddy waters make it easy to catch fish”

Looking ahead however, the case for a broad-based global economic recession is not cast in stone, as regional dispersion remains large. In the US, elevated private sector surpluses, strong corporate and household balance sheets (low debt levels), and still high corporate profit margins provide a buffer against weaker economic growth.

Europe is most at risk from energy disruptions and import price inflation (weak euro): natural gas flows have fallen by around 60% since mid-June with the TTF natural gas price rising by 130%. As the G7 consider a price cap on Russian oil, a retaliatory cutback in Russian production could backfire and push Brent prices above $200 per barrel. Going into the winter, these energy disruptions may put the European economy into a severe recession. At the same time, reopening dynamics and a positive credit impulse suggest a more constructive outlook for China. The rest of Asia seems stuck in the middle.

In times of regime change (in this case, recession risk within an environment of structurally higher inflation), large divergences of opinion and high uncertainty are reflected in elevated financial market volatility. Also, the risk of a policy error is notably high. At the same time, we like the Chinese proverb “muddy waters make it easy to catch fish”, suggesting that dislocated markets provide ample opportunities for active, creative and diligent investors.