Investing for systems change

As a hands-on impact practitioner, Dimple Sahni engages in many dialogues at the forefront of sustainable investing. Here, she shares views about the portfolio strategies able to navigate constant change.

Author: Dimple Sahni, Managing director of Impact Portfolios.

I am often asked what the next stage of impact investing is. How to allocate capital towards solutions that bring about systems change is one conversation I am having more frequently with peers in the impact community. The sort of change that results from a scalable disruption of the interrelated systems that underpin society.

For now, we are only scratching the surface of this seismic new wave in sustainable investing. But there are already useful lessons for investors. Namely, applying systems thinking and looking at societal issues, and so the solutions, through a holistic lens can help you to build or pick a portfolio strategy that can navigate an era of constant change. It also enables you to see the value in cross-collaboration to further grow the impact ecosystem and work on scaling the solutions.

Taking a holistic view

At Anthos Fund & Asset Management (Anthos), we are a values-based asset manager that has invested for nearly 100 years across multiple different asset classes. Our edge lies in accessing the best managers globally to outperform nominated benchmarks while being a Force for Good.

Our conviction is that our fund of funds business model enables us to focus on our clients’ goals and values more holistically, while it also means we can take an objective view when assessing the investment opportunities most likely to fit our criteria. Further, we can objectively judge underlying managers’ performance and whether they are performing on our necessary criteria, and engage or act accordingly.

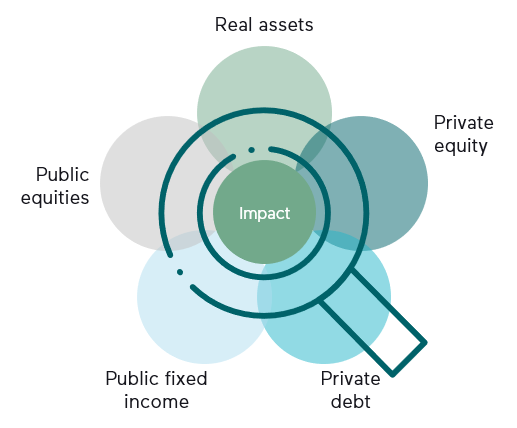

When it comes to impact investing, we have found significant merits in applying this holistic thinking. After many years of lessons of impact investing mainly in the illiquid, private markets, it helped inform our decision to evolve our approach to include all asset classes and to focus on an all-weather portfolio that could deliver on both impact and financial return.

Our multi-asset impact strategy

|

What? |

Why? |

| Multi-asset class approach, underpinned by a strategic asset allocation (SAA) |

|

| A balanced approach to emerging and developed market economies |

|

| Impact, financial, and capital deployment justification for each asset class and its role in our multi-asset impact portfolios |

|

Identifying two types of change

This evolution took place in 2018 which resulted in a multi-asset impact portfolio that included liquid assets as well as illiquid assets, underpinned by a robust and asset-agnostic impact management methodology.

We have already learned some valuable insights as to how change (impact) happens and importantly how it happens differently in different asset classes.

We use the Impact Management Project (IMP)’s ABC methodology (Acts to avoid harm, Benefits stakeholders, Contributes to solutions) to identify the types of change (impact) we are looking to see with our investments (for a detailed look at our impact methodology, read our Impact Investment Policy). This has enabled us to see a difference in the sort of change that happens within liquid, listed security investments and illiquid, private market investments, both of which impact the real economy in different ways: systems change and change at the grassroots level.

Systems change

The idea is that to achieve a systems change, it is not enough to simply invest in “best-in-class” funds or companies that simply have low emissions. Rather, we deem it imperative to invest in listed strategies that contribute to the solutions (using the IMP framework to assess this with precision).

As a fund of fund managers, we also assert our influence by asking for better alignment of impact at the total portfolio level by using the IMP framework as a guide, as well as our many years of practical experience in managing impact strategies to engage our managers and help them to think more holistically about how they are contributing to solutions.

By seeking those strategies that contribute to society, and then engaging with the fund managers on improving their impact further, expanding the potential impact we can have.

One of these is a global multi-sector impact public equities strategy, set up by an established manager because values-based investors like Anthos are asking for them. Our advantage is that experience has taught us to know what it is we’re asking for, and our impact methodology is the common language we use to speak with our managers. Other than exceptional credentials and a desirable portfolio of “tomorrow’s winners” (mapped to the SDGs), The strategy has an impact and engagement methodology which is geared towards maximising positive impacts and minimising negative impacts with clear measurement. This active approach to engagement synergises with our approach and methodology, which makes it a good fit for our portfolio. Through investing in high-growth “winners” of sustainable transition pathways, we are also confident of the manager’s ability to deliver on its long-term financial objective, which meets our other criteria.

Grassroots change

In order, however, to maintain our commitment to change at the grassroots level, we have chosen also to continue investing in private markets, with a preference for emerging markets, to help empower small and medium-sized enterprises in the world’s faster-growing economies.

The second iteration of an Asian multi-sector impact private equity strategy is a good example here. The first strategy was incredibly successful in identifying investment opportunities that improve the well-being and livelihoods of low-income communities in Southeast Asia and China. It helped more than 15 million low-income individuals benefit from higher income, better access to financing, and affordable products.

The second iteration of this strategy (which we are involved with) intends to invest similarly, investing in private high-growth companies in sectors like agriculture, education, healthcare, and logistics, or that focus on improving the accessibility of affordable housing, and sanitation, clean water, and energy. We believe investing in this strategy is a great opportunity to help underserved communities, which also represents high growth potential for our investors.

Such private, high-impact strategies and managers are highly regarded in the private markets and are often oversubscribed due to the demand for deep-impact solutions to solve world issues. This is where Anthos’s credibility in the private markets is a key strength when it comes to identifying and accessing such opportunities. In the case of the Asian multi-sector impact strategy, we will also be playing the role of the Limited Partner Advisory Committee (LPAC) to further advise and engage on impact.

How this works in practice

Longer-term, the world’s best “business plans” in form of the United Nations’ Sustainable Development Goals and the Paris Climate Agreement are our North Star.

In the shorter term, however, we believe the need to be adaptable and flexible with an all-weather portfolio is critical to achieving the triple bottom line of financial risk-adjusted return and impact with a performance profile smooth enough to fit within a total portfolio mix whose overarching aim is to achieve both long-term wealth generation and impact smoothly. The fact that we are currently navigating through a devastating war and humanitarian crisis, with meaningful economic impacts paints this point starkly.

In practice then, our holistic and multi-asset portfolio strategy approach works like so:

- Investing in public equities and sustainable bond investments enables systems-change impact by investing in promising solutions and then influencing further impact via engagement, while also providing liquidity and attractive risk-adjusted returns to investors;

- Meanwhile, capital allocated towards the private market investments can stay “in the ground thereby enabling grass-roots impact to happen. With private projects, capital needs to “stay in the ground” due to initial costs and expenditures which tends to lead to a loss before the project can become profitable and productive. This trend is depicted in the “J-curve” where there is a dip, followed by a sharp incline in terms of return on investment;

- The above enables investors to receive a healthy risk-adjusted return, with better liquidity, which enables them to stay invested in impact investments for longer;

- Ultimately, this creates impact at scale for it removes many of the barriers for investors to invest in impact.

Applying systems thinking to our impact portfolios

Systems change may be the next wave of sustainable investment but there is no need to wait to apply this thinking to a more holistic impact portfolio strategy. For us at Anthos, the key lessons are to look at those societal issues and so solutions holistically, using the common language of the impact ecosystem (such as the IMP framework) to speak about the same expectations, visions, and outcomes. It’s also vital for us to use our many years of experience investing in “deep” impact projects in the private markets to help managers across asset classes improve their impact further.

As impact investors, we are building an ecosystem where improvements and knowledge can and should be shared as much as possible. As with this piece, it’s also key to share the evolution of impact investing. No longer is it isolated to a single asset class, but rather there are exciting opportunities for growth in both impact and financial return across the investible universe. As more investors understand this, the more the capital allocated to the solutions that contribute to society grows along with further alignment across all actors working towards the same North Star. Against that transformative backdrop, an all-weather multi-asset impact portfolio may be particularly well-positioned to navigate an era of constant change.

Further reading

- Anthos’ Multi-Asset Impact Strategy

- Deep Transitions

- Explaining tough concepts: The “J"-Curve of private equity investments

This is a marketing communication. Please refer to the Private Placement Memorandum of Anthos Fund II RAIF-SICAV S.A. ("PPM") before making any final investment decisions. The PPM may be provided upon request. Please note: that these funds are open to professional investors only.