OCIO solutions: optimising the endowment model

Anthos has deep roots in philanthropy, having helped charitable entities manage their investments since we were founded in 1929. Here, we provide our six principles to help these investors navigate a new era of challenges.

Authors: Jacco Maters, CEO (left) and Roger Dayala, Head of Investment Department (right), Anthos Fund & Asset Management

Foreword

There has been much discussion about and praise for the effective investment strategies of the largest endowments over the years, such as the US Ivy League universities Harvard, Yale, and Stanford. Coined the ‘endowment model,’ these portfolios often include significant allocations to alternative asset classes such as private equity, absolute return, and real estate. Taking long-term attitude towards risk, actively managing their portfolios, and using a sound strategic asset allocation (SAA) approach are all core to the strategy’s success.

The reason it is called the ‘endowment model’ is because this strategy was pioneered by those US institutions in the 1930s when they re-allocated their endowment funds to equities (this was considered novel and risky in the post-1929 equities slump). It was then made famous once again in the 1980s, with David Swenson of Yale leading the way to switch from equities to alternatives (again, considered novel and risky), which helped achieve higher returns with less volatility.

Yale is a good example of this strategy in action, delivering an average annual return of 11.3% over the past 20 years,[1] outperforming both the S&P 500 and the average college endowment. Yale’s strategic allocation to alternatives, which today comprises more than 50% of its portfolio is to thank. The simple proverb “spend within your means” holds true for all, especially when the endowment fund is the main source of revenue for a mission-focused institution.

Unique challenges of smaller endowments and charities

Most other endowment funds do not have the same resources or cash buffers as Yale to enable them to take such long-term and bold attitudes towards risk, nor are they able to easily access the lesser-known alternative markets. In fact, smaller endowments face a very unique set of challenges in the current climate.

They too need to earn high returns – aspiring to earn at least 5% per year – to protect and grow their wealth to meet their spending requirements when adjusted for inflation. At the same time, they have limited resources and face a vast set of opportunities to choose from to achieve their investment goals. The acceleration of technology, increased access to capital and greater institutional adoption of alternatives have all put pressure on excess returns. Finally, the regulations and expectations associated with environmental, social, and governance (ESG) investing, coupled with the associated reputational risk if a mission-focused institution gets it wrong require serious attention. In an environment where higher inflation and diminishing returns for traditional assets are expected to stay, smaller endowments have big challenges ahead of them.

As a values-based investor with skin in the game that has helped foundations manage their investments since we were founded in 1929, here we offer guidance on how smaller endowments and charities can optimise their investment strategies with these six principles.

Anthos’ endowment model principles

In our view, the successful endowment model strategy adopted by the largest institutions can also be applied to smaller funds; it is the execution that must differ, slightly. Below we highlight some of the ways smaller funds can apply these principles.

1. Strategic asset allocation

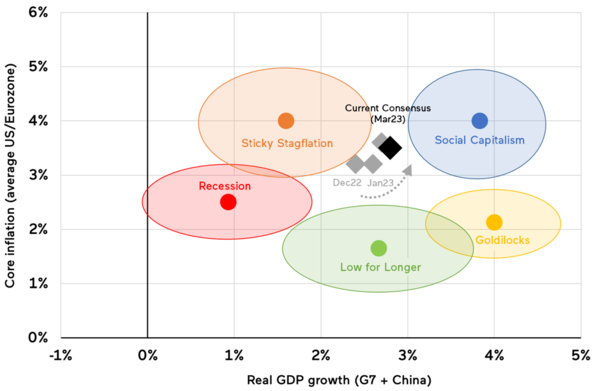

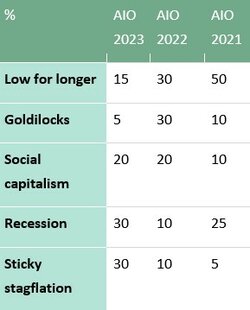

The typical 60% equities and 40% bonds asset allocation mix has been questioned for some time now. Where it worked well in the 1980s and 1990s, more recently elevated equity valuations, extraordinary monetary policies, increased risk in fixed income, and the explosion in technology have impacted the growth and operation of industries and economies. You cannot invest for ‘just’ one future anymore; you have to invest in multiple futures. At Anthos, for example, we model probabilities for at least five investment scenarios we consider for our SAA.

Macroeconomic scenario framework for 2023-2024

2. Allocating to alternatives

The University of California’s recent USD 4bn investment in Blackstone’s real estate fund is typical of the endowment model in action for a large institution: a significant alternative investment, illiquid, a USD 1bn backstop, and contrarian. These are risks many smaller endowments cannot take.

Instead, they can look to allocate to alternatives in a more considered and selective way. By hiring managers with deep asset class expertise, access to investment opportunities, and long-term track records, that also offer significant value for money over premium fees. Investors can build an alternative exposure that reflects their risk/return profile. This is the case for absolute return strategies, private equity, private real estate, and impact investments.

We underpin this with the recommendation to conduct thorough due diligence and find managers with strong ESG principles and responsible investment policies in place.

3. Long-term attitudes toward risk

Even for the largest endowments in the world that fail to accept necessary levels of risk today

will likely result in capital depletion in the future. Consider, for example, that Yale currently spends 5.25% of the endowment value, which is the amount projected to be sustainable given reasonable long-term growth expectations in the endowment’s value, adjusted for inflation. Over the course of a decade, Yale spends more than half the total value of the endowment; at its current rate of spending, without growth for investment, the endowment would be entirely depleted in less than 20 years.

A question all endowments and foundations should ask themselves today is “does my investment policy take enough risk to ensure continuity of spending requirements for the next 50 years?” If the answer is that levels of risk today do not consider inflation, and only seek to preserve capital rather than grow it, then it is time to reconsider the portfolio’s investment policy.

4. Active management

It was Warren Buffett who in 2016 challenged the endowment model, stating that failure to beat an indexed 70/30 portfolio should imply that endowments and foundations should simple buy ETFs and save the fees associated with active management.

However, less efficient areas of financial markets are alternative spaces and bourgeoning sectors that can justify paying fees. Among other things, those active strategies benefit from identifying macro trends of the future such as the energy transition. Active managers are able to create combinations of assets across liquid, illiquid and alternative markets to ensure necessary adherence to a fund’s investment policy. It also enables tactical opportunities and revisions based on an endowment’s changing needs where passive investing cannot.

Our advice is to find cost effective active strategies across the asset class universe, and to only entrust the fiduciary management of the total portfolio with active experts who have sound judgment of both your needs and the financial markets.

5. Prudent spending

Even the largest, most successful endowments and foundations in the world follow prudent spending as a core principle. Optimising an endowment model investment strategy means adopting ‘balance sheet’ thinking rather than treating liabilities and cash flows as separate from the investment strategy. In this light, the fund is not dependent on donors’ contributions. Instead, the fund can adopt a spending rule to make the annual trade-off between commitments and spending explicit, limit variation in the budget for additional investments and give direction to the return target for the investment portfolio.

6. Responsible investment

A sixth principle which is not typically found in the old model is how responsibly endowments and foundations can, and should, invest. Another way to approach this is to ask the question, “what impact is our investment portfolio having on society?”

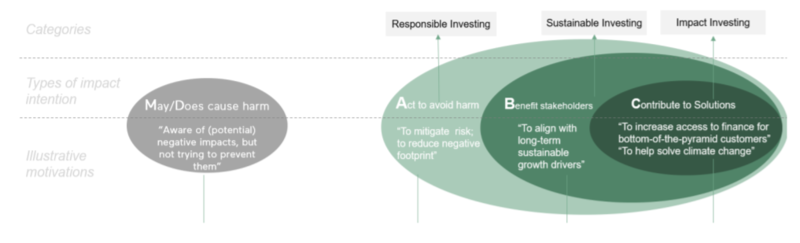

In our world at Anthos, we classify different types of investments by the impact they have on the world: responsible, sustainable and impactful. Roughly speaking, responsible acts to avoid harm, sustainable seeks to align with positive societal themes and benefit stakeholders, and impact seeks to intentionally and measurable generate positive outcomes to contribute to solutions in society or the environment.

The way we define different types of investment

Source: Impact Management Platform (IMP) ABC Framework

All are profitable investment styles. We can therefore say with certainty that it is possible to generate strong investment returns whilst also investing responsibly.

Even for endowments and foundations that create impact through their missions, we still recommend to invest as responsibly as they can to achieve their investment goals. They should conduct their due diligence, speak to experienced investors, and seek expert advice to ensure they find a fiduciary manager that can effectively translate this desire into a sound investment strategy.

Conclusion

Optimising the endowment model requires a nuanced and multi-faceted approach. Successful endowments have a long-term outlook, actively manage their portfolio and make selective allocations to alternatives, while also incorporating ESG considerations and managing balance sheet and liabilities effectively. One of the most important factors in achieving success is hiring the right team of experts who align with your values and have a deep understanding of the unique challenges faced by endowments and the charitable sector. Investing in human capital is just as important as investing in financial capital, as it can lead to superior returns and help achieve your mission in a sustainable manner.

We believe these keys to success should be top of mind for every endowment looking to optimise its investment strategy. As we enter a new investment regime where there is no shortage of challenges, staying ahead of the curve and future-proofing your portfolio is essential to continuing your mission for the long-term.

Find out more about how we can help mission-focused investors here.

[1] As at 30 June 2021.