About our IMP methodology

In this "explainer," we’re delving into our Impact Management Project methodology (IMP for short), which we adopt to understand the impact intention of all investments at Anthos.

Following our last “explainer” about our ESG methodology, now we’re delving into our Impact Management Project methodology (IMP for short), which we adopt to understand the impact intention of all investments at Anthos Fund & Asset Management (Anthos).

Some background

As early pioneers of impact investing, Anthos came to understand the challenges in impact measurement from managing our own impact funds. Anthos embarked on a research project alongside Bridges Fund Management to answer some of these challenges, which resulted in the publication of this “More than Measurement” case study in 2016.

That case study went on to inspire some of the foundations of the soon-to-be Impact Management Project (IMP), which sought to bring together practitioners to build consensus and standards for impact investing. One of the conclusions of the project was the creation of “impact management norms” – a shared logic for managing impact on people and the planet. These norms were facilitated by the project and its practitioner community of over 3,000 enterprises and investors, which included Anthos. Find out more about the impact norms here.

What IMP norms do we use at Anthos?

Our dedicated impact portfolios touch on all the impact norms, whilst the rest of our strategies focus on just one of the “building blocks” – the “ABC” norms of impact classification:

IMP labels, explained

May/Does cause harm: The absence of policies, processes or activities to measure, monitor and mitigate the negative impacts caused by the asset.

Act to avoid harm: Seeks to mitigate the negative impact of an investor’s portfolio, by for example incorporating ESG factors into investment decisions, accounting for and mitigating negative impact, engagement, and other activities to avoid harm. We expect from a fund that ‘acts to avoid harm’ to advocate for more sustainable practices through engagement with portfolio companies, through voting practices, by sitting on the board of companies and lead towards a more sustainable world.

Benefit stakeholders: Seeks investments intended to generate positive outcomes for a wide range of stakeholders. This can be done by, for example, positively screening for investments that are sustainable for the world either by consistently mitigating their negative and providing positive contributions or by being in industries that traditionally provide positive outcomes, e.g. healthcare, or education.

Contributes to solutions: Seeks investments intended to generate measurable significant positive, social and environmental impact for otherwise underserved stakeholders, including the environment.

How do we use the ABC norms?

We use these norms in our “IMP scorecard.” This scorecard is a tool that helps us to assess any given underlying fund in our fund-of-funds portfolios on the type of potential impact during due diligence and post-investment for engagement and monitoring.

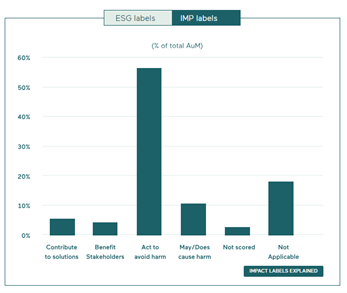

Looking at an underlying fund's impact intention allows us to understand the type of impact a fund could have on the world: whether it may be negative, if the manager is going to aim – through its responsible investment practices - to minimise its negative impact and influence companies to change their business practices, or if the fund will have a positive impact on all stakeholders or more specifically underserved stakeholders. We can also set key performance indicator (KPI) targets as a firm, because we can aggregate the total assessments to get a rough indicator of the impact intention driving all our investments. As you can see from the chart below, the majority of our assets under management act to avoid harm (A):

Source: Anthos Responsible Investment Report 2022.

What are the advantages of this approach?

Using the IMP norms helps us build intentionality into our responsible investment frameworks and processes which builds awareness, guides conversations with managers, and also helps us think strategically about the type of impact we want to see – this is not only in our dedicated impact portfolios, but for all asset classes.

What are the limitations of this framework?

The ABC impact norms were originally designed to assess a company’s type of impact (not fund of funds portfolios). We therefore had to adapt the norms to our context and way of investing.

Of the many lessons we’ve learned, sometimes it is difficult to differentiate between those investments that benefit stakeholders (B) and those that contribute to solutions (C). This is especially true of diversified funds with many companies; some aim for B outcomes, some for C, and some managers of those funds want to achieve both B and C. Another lesson learned is that sometimes we see good impact outcomes, but it’s not well codified in an impact intention or sustainability objective by the manager. We try to engage with the manager in those cases to understand why. After all, intentions do not equate to impact outcomes and so need to go hand in hand with good ESG practices and robust monitoring of impact outcomes to gain as complete a picture of how change happens.

Seen in a different light, these limitations lead to learnings. We have come to realise that these classifications should not have value judgments attached to them – one should not be seen as better than the other, for the world needs all three types of impact: A, B and C. Think of a company in a fund that is aiming to avoid harm (A) that has started to pay out living wage as a part of their efforts to mitigate the negative impact in their supply chain. Or a company in a fund that is contributing to solutions (C) that is providing access to finance, health or education to underserved communities. This recognition leads to critical discussions across our investment teams about how we can best support and align with those funds that contribute or generate the most positive impact possible, whilst also achieving financial outcomes for our clients.

How do we expect to evolve this approach over time?

We would hope to see continuous alignment with well-recognised regulations and sustainability standards so that the IMP norms and indeed all of the IMP building blocks remain relevant and useful to investors. We would also hope to see more guidance for fund of funds investors, taking into consideration the limitations and complexities in this space.

Crucially, for our own approach, we want to continue working to embed quantitative outcomes and impact measurement to support our assessment and monitoring of any given fund’s impact intention and actions. That way, we can better assess, monitor and manage our investments for the impact we want to have in the world.