Guidance to practice: lessons from getting started with our net zero ambition

As responsible investors, we felt impelled to set an ambitious net zero target for 2040, which is ten years earlier than the Paris Agreement.

Authors: Bastiaan Pluijmers, Head of Investment & strategy research, Jelena Stamenkova van Rumpt, Director of Responsible Investment, Lucy Bowen, Senior investment writer.

The first steps are often the hardest. This is certainly the case with investing to tackle climate change, which has two dimensions:

- Risk-return: how the climate crisis creates risk and opportunities?

- Impact: how much do we contribute positively or negatively to the problem?

Known as double materiality, these dimensions are both crucial and challenging problems to solve.

At Anthos Fund & Asset Management (Anthos), we also care deeply about leading by example as responsible investors who allocate capital to strategies across the investment universe of liquids, illiquid, and fiduciary solutions. We set our net-zero ambition for 2040, so we could play this influential role. The theory is to use the “extra” ten years to help our clients, underlying managers, and other market participants to transition faster. We hope to raise the likelihood of all achieving the Paris Agreement and keeping global warming below 1.5°C.

As we embarked on our journey, we wondered whether the degree of separation between us and the carbon-emitting companies (via external managers) would decrease the influence we could have.

As this paper shows, it seems this is not the case. By starting the hard work to understand our portfolio carbon footprints and where the most emissions come from, we can already see where the most reductions can be made, which informs how we can act. In this piece, we explain what our action “levers” are, and how we intend to systematically apply them to all our investment portfolios on our net-zero journey.

Step 1: Goal setting

From the outset, our goal was to align with a 1.5°C pathway in line with the Paris Agreement. We signed up to the Dutch Climate Agreement in 2019 to understand how other constituents and asset managers were mapping out their own net-zero strategies. As mentioned, we believe our role as responsible investors is to lead by example and then pass on the lessons to our clients, underlying managers, and other market participants to transition faster. We, therefore, decided to set our net-zero ambition for 2040, rather than 2050.

We knew this would require us to move faster, and perhaps work a lot of it out for ourselves (for example, within the more opaque areas of the market, like emerging market debt or traditional private equity, or what to do with money market funds). Despite these trepidations, we saw a more ambitious net-zero goal to be aligned with our values and that of our clients. It is also key to note that we saw it as an opportunity – the energy transition requires innovation and unprecedented growth in the adoption of the solutions. As investors supporting those solutions, we would be contributing to the green energy transition as well as taking advantage of a significant value-creation opportunity. As responsible investors, it, therefore, made complete moral and business sense. The two go hand in hand.

The next step was to work out what to measure and what to target. For our fund of funds (FoF) set up, we followed the guidance of the Taskforce on Climate-related Financial Disclosure (TCFD) regarding the governance and risk assessments. For carbon accounting we followed the Partnership for Carbon Accounting Financials (PCAF) and for net zero, we used the Institutional Investor’s Group on Climate Change (IIGCC)’s net-zero investment framework guidance. We also consulted with other companies across the COFRA group, hired consultants and experts, and engaged with our underlying managers to assess what they were doing, which was variable across the different asset classes and more advanced in the liquid spaces. This highlighted the need for a strategy that could work across all our investment capabilities, whether liquid, illiquid, or the fiduciary advice we give to asset owners.

We arrived at two approaches recommended under the Paris Agreement to calculate and measure our carbon footprints now and as we move forward, which will change over time as the science and carbon accounting methodologies improve. One approach is to measure historical and current carbon footprints, and one approach is to project how companies’ carbon footprints will develop moving forward.

Our intention was to understand how our climate impact is best measured, how to get a complete picture of where we are and where we need to go, and analyse what portfolio actions and decisions we could take to realise consistent emission reductions over time. Our analysis suggested that it was possible for us to achieve net zero across our investments by 2040.

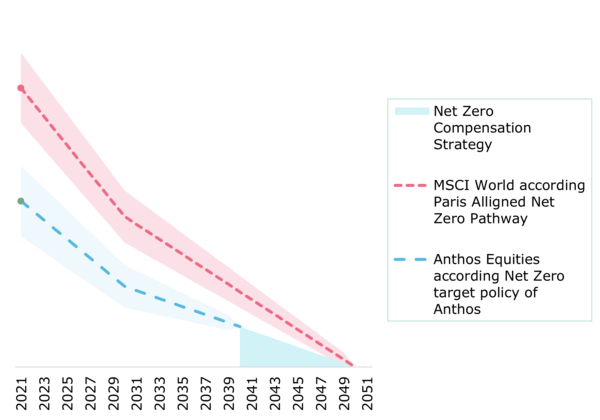

So, in early 2021 we stated our commitment publicly with the baseline of 2020. We illustrate this 20-year pathway, using our equity portfolio as a proxy for all our investment capabilities, in Figure 1. We compare it against the MSCI World pathway, which aims for 2050.

Figure 1: Anthos’ net zero carbon ambition by 2040

Step 2: From goals to actions

Once we had set and committed publicly to our goal, we set about implementation. As a FoF manager, we wondered whether we would have less influence due to the degree of separation from the carbon-emitting companies. After doing the work to understand our carbon footprints outlined in Step 1, we realised this was not the case.

In fact, we learned that the three “levers” we must influence change may be powerful from our holistic FoF viewpoint because the conversations we have with our longstanding managers may impact entire portfolios of companies, rather than just one. What is more, as a multi-manager, we may invest in the same manager but separate strategies depending on the asset class. Or as is the case with our multi-asset impact FoF portfolio and equities FoF portfolio, we even invest in the same underlying equities strategy in both portfolios due to this strategy’s considerable profile as a positive contributor to the energy transition.

Another point here is the role we often play in co-creating or seed funding promising new strategies. This has enabled us to be front-footed in negotiating competitive fees for our clients but going forward it will be ever-more important to maximise emissions reductions through engagement, also through co-creating, for example, new strategies that tackle the energy transition in underrepresented ways. Therefore, our position as a FoF manager may even strengthen, rather than dilute our influence – especially because we act in close alignment with our clients who are asset owners who represent much larger investment pools.

Underpinning our ambition to be a guide and leader in decarbonisation is what we believe to be the most crucial aspect of our investment approach: our ability to select and provide access to the best managers and strategies globally. When it comes to the energy transition, many managers have unique specialisms or expertise which we can then leverage and apply to our own portfolios. In many instances, we find the lessons from one asset class strategy apply to another, or even many, so the result of this knowledge sharing is multiplied across the Athos whole. Continuing to select, support, and learn from the best managers, combined with our action levers is the core of our decarbonisation strategy.

The three levers we describe below are consistent with the market recommendations as to how to maximise carbon emission reductions. An important note to make is that an exclusionary strategy should be considered one of last resort – exclusions in a portfolio do not reflect emissions reductions in the real economy, where it matters. We, therefore, propose engagement and supporting the green solutions, rather than focusing on exclusions.

The three levers of action are:

1) Engagement on emissions with external managers

- Engage and encourage engagement on the highest emitters

- Promote and ask for Science-Based climate targets*

- Improve environmental data quality

2) Allocate to “green” investments

- Solutions-focused investments

- Strategies with explicit climate strategies of science-based targets

3) Avoid exposure to heavy polluters

- Companies with 10% revenue from thermal coal

- Companies with 10% revenue from oil sands

- Companies with 5% revenue from Arctic oil & gas exploration

Lever 1: Engagement on emissions with external managers

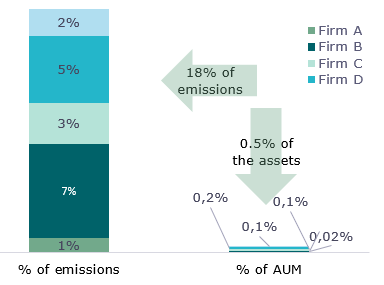

The first lever focuses on engaging and encouraging engagement with underlying managers and their underlying companies. The below diagram shows an analysis of our equity portfolio at Anthos. The column on the left shows the five biggest polluting companies in the whole FoF portfolio representing 18% of total equity portfolio emissions, while only being approximately 0.5% of the portfolio assets under management (AUM). Before doing anything, the data reveals where the weight of the problem lies and at the least cost. This makes a conversation with the external manager that owns these five companies very transparent and focused.

Figure 2: Engaging the top five polluters could result in meaningful reductions

If these five companies were to adopt Science-based targets due to encouragement and engagement, we can assume with a margin of safety that 9% of equity portfolio emissions will be reduced by 2030, and another 4.5% by 2040. We make this assumption because Science-based targets provide a reliable base that these companies will follow clearly defined paths to reduce emissions that is in line with the Paris Agreement.

We also use a third-party engagement specialist to directly engage with polluting companies on specific themes we care about and material risks in the portfolio including climate change. This is another way to influence directly with companies and expand our leverage through alignment with other investors as part of collaborative initiatives. This complements the main engagement we do at the FoF level.

Lever 2: Allocate to green investments

The second lever focuses on increasing investments in strategies and managers that are the winners of the green energy transition. These are actors that do not simply reduce emissions, but that contribute to the solutions in meaningful and measurable ways. For example, companies that through their products and services contribute to solutions to the climate challenge. We have the ambition to increase our sustainable and impact investments to be 25% of our total AUM at Anthos by 2025. Through our early work in impact investing, we are a step ahead of the curve in this respect which is an advantage we intend to maximise going forward.

We describe the approach to the change we want to see in the real economy and the type of sustainable and impact investments we support at Anthos in this thought piece by our Head of Impact Portfolios, Dimple Sahni, Investing for systems change.

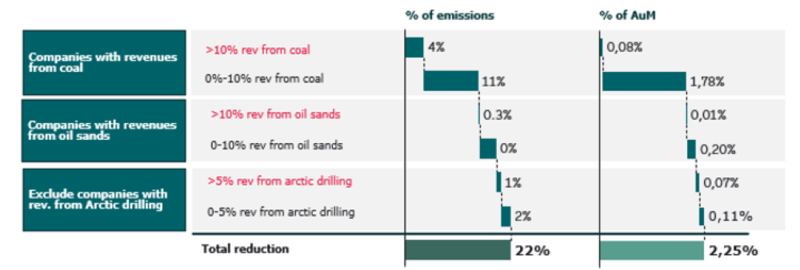

Lever 3: Avoid heavy polluters

The third lever addresses investments in the heaviest polluting sectors. As stated already, this is a lever of last resort given we are most interested in reducing emissions in the real economy, not just our portfolios. That said, we use exclusion thresholds to focus our conversations with managers on the areas we are most concerned about. As a FoF manager, this is difficult to do but the carbon analysis of our equity portfolios gave us insight into the areas where we needed to focus our engagement efforts.

The diagram below shows how analysing our equity portfolio brought to light exposure in the heaviest polluting sectors totalling 22% of our total emissions, but that this made up only 2.4% of our AUM. The simple mathematics show the net benefit of addressing investments in these companies in terms of carbon emissions. We strive to exclude companies that generate 10% of revenue from thermal coal generation and exploration and oils sands, and companies that get more than 5% revenue from artic oil & gas exploration. In addition, we increasingly engage with the external managers on the companies with revenues in these sectors, with our exclusion threshold below.

Figure 3: Anthos’ exclusion thresholds

As a FoF manager, we cannot fully avoid exposure to the issuers we aim to exclude. As our responsible investment objective is to increase our positive impact through engagement rather than exclusion, we do not see this as a fixed rulebreaker. Engagement, not exclusion, is the better tool for achieving change in the real economy, and we expect the same from our external managers. Please read our exclusions policy for more information.

Good reasons may exist to stay invested even when a company generates carbon emissions above the desired thresholds, for example when the company has strong and tangible ambitions to replace damaging activities with sustainable activities or has a clear net-zero strategy and target approved by the SBTi. The key thing is not to assume exposure to heavy emissions at an absolute level means exclusion should be the best approach. But to demand what the theory of change from the underlying manager is in terms of their carbon reduction plans and how they intend to achieve them. The direction of travel, as well as the speed, is important.

A good example of this is one global equity strategy we are invested in, which engages with heavy emitters on transforming their systems through applying science and expert advice along with accountability. In this way, they are applying a robust theory of change rather than a simple avoidance strategy.

Compensation

Lastly, a clear compensation strategy must be part of our ambition and net-zero policy. We would like to be pleasantly surprised come 2040 that we do not need one, however, the reality we fear is that the larger part of the market will still be grappling with reductions. Given the investible universe would reduce to a fraction if we were to only invest in net-zero strategies, we believe compensation must be part of our strategy as the market races to the finish line. We are now working with businesses across the COFRA group to learn and collaborate on our compensation strategy.

Step 3: Collaborating and continuously learning

Last but not least is the recognition that we cannot do this alone. The space of sustainable investing and all its siloes is evolving at an exponential rate. But as new approaches, terminologies and solutions enter the market, what’s clear more than ever is the need to collaborate, consolidate and share information so that we are all striving for the same goal.

The energy transition is an exciting growth opportunity, where many investors have benefited from the explosion of innovative ESG solutions that promise both impact and financial return. However, greenwashing and misleading information both intentional and otherwise pose serious threats to true and proper progress in achieving the goals of the Paris Agreement.

As responsible and ambitious investors, we believe it’s possible to move fast and not break things. On the one hand, by being open about all we are doing through better sustainability reporting. On the other, collaborating and learning with the institutions, collective groups, and initiatives working hard to consolidate the pathway to net zero.

Anthos is committed to supporting the development of further guidance and field-building through, for example, being a member of the Dutch PCAF, where we are contributing to a number of consultations, Their guidance was very helpful, especially in the beginning when figuring out the rules of carbon accounting. We are also a member of the IIGCC, where we are part of relevant working groups collaborating to further develop the methodology for climate integration across different asset classes. We collaborate within the Dutch Fund and Asset Management Association (DUFAS) to share and learn from peers in the context of the Dutch Climate Agreement commitment to reporting and target setting. We are also working with our sister organisations (and COFRA) to improve tools and broaden understanding in a multi-disciplinary setting where we leverage the expertise and processes from across industries. An example is contributing to the SBTI Guidance for Private Equity in collaboration with our sister company Bregal, which spearheaded this project. And finally, contributing to thought leadership initiatives and events like the Phenix Impact Summit, or this knowledge sharing paper to continue having meaningful dialogues.

All of which help us to understand the problem, the solutions, and the implementation strategies we must take to meaningfully and consistently achieve our net-zero ambition and encourage others to do the same.

Conclusion

Though we attempt to simplify the journey we have taken to set and action our net-zero ambition in “three steps” in this paper, we empathise with other investors that the task at hand is indeed difficult. Our work has just begun, even though we are a few years in. Even formulating our thinking on the topic and how we would go about it was a challenge. We’d also like to point out that the work we have done so far applies to our liquid strategies, where we are now focused in 2022 on applying the lessons learned and conducting the necessary carbon analysis on our other illiquid portfolios which will be more challenging.

By publicly setting our ambition, however, and recognising the fact that collaboration, field building, working closely with clients and other actors, and working hard at the problems are all part of the journey, we are confident that we can achieve our net-zero ambition. As we do, we will continue to pass on the lessons to our clients, underlying managers, and other market participants, as we are now doing.

In summary, the steps we have taken so far are:

Step 1: Led by example in setting goals that aligned with our values and the future we want to see, not just the industry norm. We assessed the methodologies that make sense for our investment model and committed publicly to our ambition to hold ourselves to account.

Step 2: Figured out our actionable levers that will steer real reductions of emissions. Ours are engagement with external managers, investing in green investments, and avoiding heavy polluters. Combined with continuing to select and support the best managers globally and learning from them.

Step 3: Collaborate and continuously learn to deepen our knowledge and practice, and to share best practices with others. We must work together and be willing to constantly evolve to solve the climate crisis.

The first steps are often the hardest, but in the net-zero journey we at Anthos found them to be the most important ones (so far).

This is a marketing communication. Please refer to the Private Placement Memorandum of Anthos Fund II RAIF-SICAV S.A. ("PPM") before making any final investment decisions. The PPM may be provided upon request. Please note: these funds are open to professional investors only.